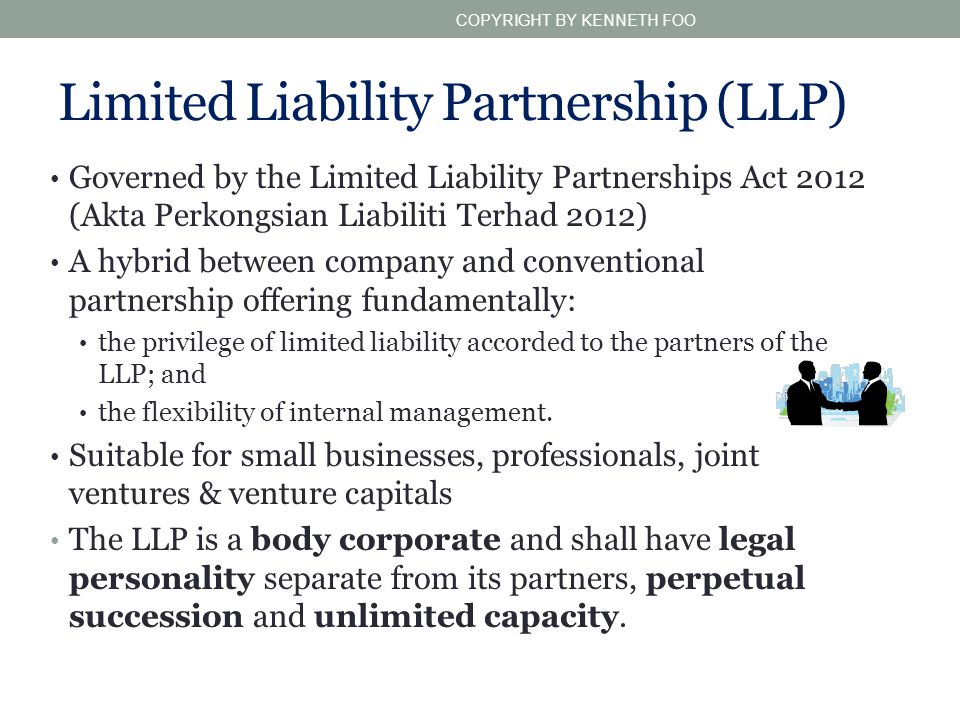

The Limited Liability Partnership LLP is an alternative business container regulated under the Limited Liability Partnership Act 2012 which incorporates the characteristics of a company and conventional partnership. 2 This Act comes into operation on a date to be appointed by the Minister by notification in the Gazette.

Companies Under the Companies Act 2016 a company can be incorporated as.

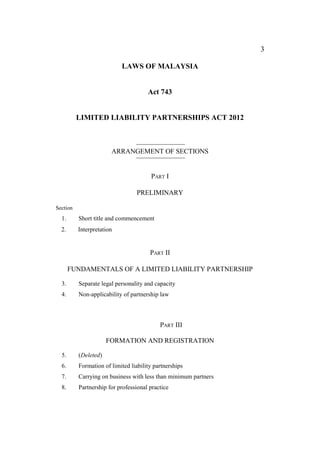

. 1 A limited liability partnership is a body corporate and shall have legal personality separate from that of its partners. For this purpose you just need to follow the 4 key steps. Short title and commencement 1.

Part II FUNDAMENTALS OF A LIMITED LIABILITY PARTNERSHIP. This is also evident in the exhibit of corporations and partnerships. Partnership Act 2012 LLP Act.

Limited Liability Partnerships LLPs are partnerships where certain partners are partially responsible for each others actions. LLP provides limited liability status to its partners and offers the flexibility of internal arrangement through an. Fundamentals Of A LLP A.

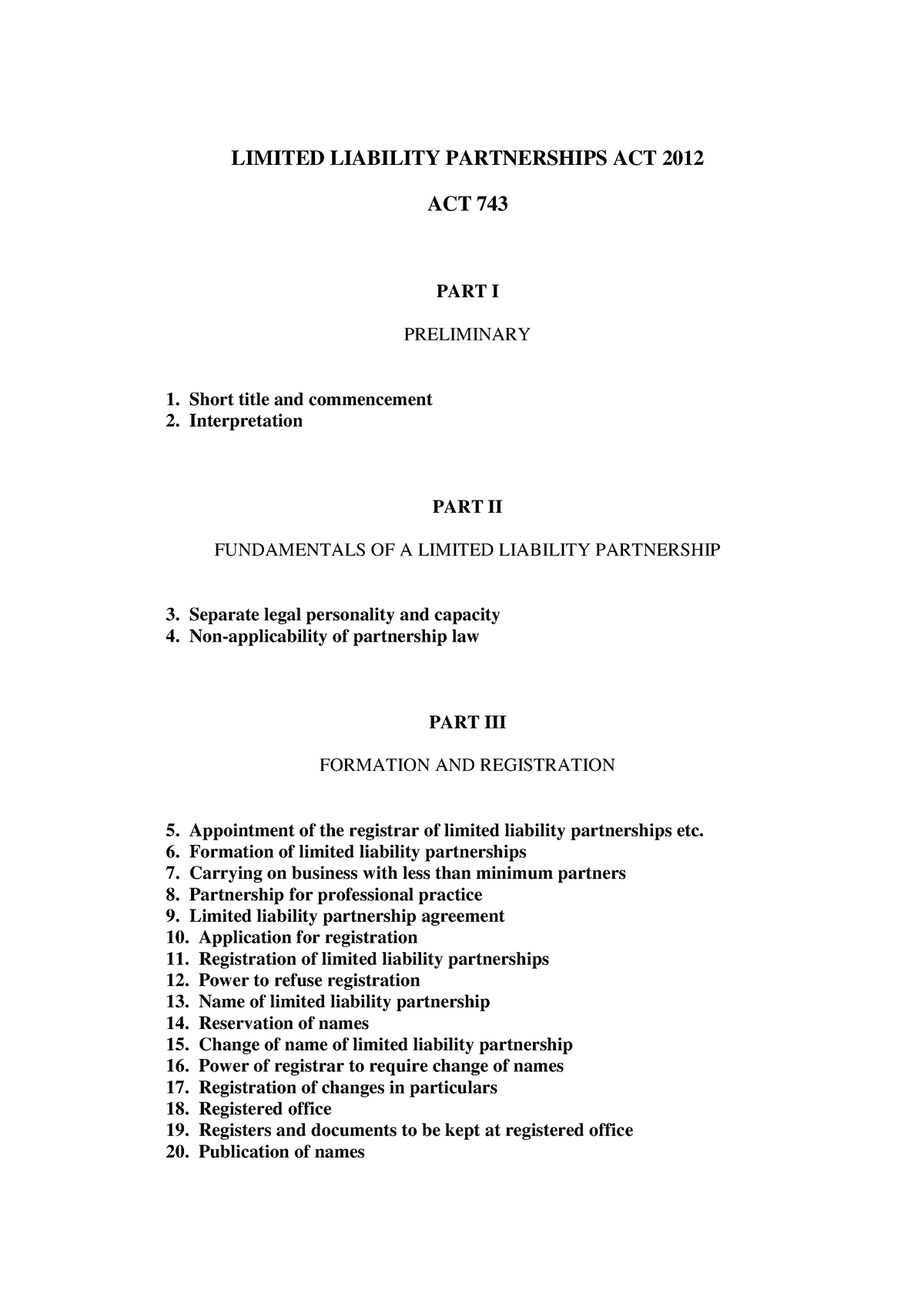

LLP is featured with the protection of limited liability to its partners similar to the limited liability enjoyed by shareholders of a company coupled with the flexibility of internal business. ACT 743 LIMITED LIABILITY PARTNERSHIPS ACT 2012Click here to see Annotated Statutes of this Act Part I PRELIMINARY. The structure of the LLP business is designed for all legally legitimate business purposes aiming to profit.

47 47A Jalan Jati 2 Taman Nusa Bestari Jaya 79150 Iskandar Puteri Johor. According to the Limited Liability Partnership Act 2012 every Limited Liability Partnership LLP in Malaysia should be registered with the Companies Commission of Malaysia CCM. Who Can Form Llp In Malaysia.

To illustrate what was mentioned beforehand 1. In 2012 they enacted the Limited Liability Partnerships Act 2012 where the Limited Liability Partnership LLP entity is designed for business owners to generate profit and indirectly boost the local economy. To assist you with the process of partnership.

1 This Act may be cited as the Limited Liability Partnerships Act 2012. Part III FORMATION AND. LLP or Limited Liability Partnership is a form of Malaysian business vehicle that offers a mix of attributes of a company and a conventional partnership.

LLP formation in Malaysia requires at least two partners to form the company. Sole ProprietershipPartnership Company Limited Liability Partnership. Publication of Name Registration No.

In this Act unless the context otherwise requires annual declaration means a declaration required to be lodged by a limited liability partnership under section 68. Manual Online Lodgement of Annual Declaration By Limited Liabili ty Partnership. The LLPA is an Act to provide for the registration administration and dissolution of limited liability partnerships LLP and to provide for related matters.

1 Notwithstanding anything under this Act a foreign limited liability partnership shall appoint at all times at least one compliance officer from amongst its partners or persons qualified to act as secretaries under the Companies Act 1965 who- a is a citizen or permanent resident of Malaysia. Every letterhead invoice bill publication including electronic medium website or other official documents issued by the LLP. To put it simply an LLP provides all the merits of the private limited companies minus their cumbersome reporting requirement.

LLP offers limited liability to its partners whereby any debts and obligations of the LLP will be borne by the assets of the LLP while for conventional partnership the partners are jointly and severally liable with the firm. Setting up a Limited Liability Partnership LLP in Malaysia is a hassle-free process. There are 3 types of business entities one can choose from to start up a business in Malaysia namely.

Guideline Limited Liability Partnership Format. General Guidelines For Registration Of Limited Liability Partnership. The LLPA has come into force with effect from 26 December 2012.

The Act allows for the creation of a partnership with legal personality in which the partners enjoy limited liability known as. The aim was for professionals such as lawyers accountants and company secretaries to use this vehicle to carry out their professional practice. 2 This Act comes into operation on a date to be appointed by the Minister by notification in the Gazette.

An LLP is defined in the Bill as a limited liability partnership registered under section 11. Guideline For Declaration Of Dissolution In A Voluntary Winding Up Of A Limited Liability Partnership. 1A LLP is a body corporate and has legal personality separate from that of its partners.

CHARTERED TAX INSTITUTE OF MALAYSIA 225750-T e-CTIM No 1462012 4 October 2012 TO ALL MEMBERS TECHNICAL Limited Liability Partnership LLP The Finance No2 Bill 2012 the Bill proposes to amend the definition of person in the Income Tax Act 1967 ITA to include an LLP. Limited Liability Partnership is an alternative type of business under the Limited Liability Partnership Act 2012 Act 743 which combines the characteristics of a private company and a conventional partnership. Obligations under Limited Liability Partnership Act 2012 LLP Act 11.

It may be formed by any two or more individuals andor bodies corporate for any lawful business with a profit motive in. Non-applicability of partnership law. Main features of LLP LLP is a body corporate and has a legal personality separate from its partners separate legal entity.

Provide professional advice related to your business set up operation and Malaysia rules compliance include company incorporation accounting payroll and etc. INTRODUCTION TO LIMITED LIABILITY PARTNERSHIP LLP 11 About LLP LLP is an alternative business vehicle to carry out business which combines the characteristics of a private company and a conventional partnership. Every LLP shall display its name and registration number outside its registered office and place of business.

Short title and commencement. 2 A limited liability partnership shall have perpetual succession. A company having a share capital may be incorporated as.

If one partner of an LLP has committed misconduct or negligence no member of the LLP will be held liable. LLP is a separate legal entity which has the unlimited capacity to hold property while the partners enjoy the limited liability status. 1 This Act may be cited as the Labuan Limited Partnerships and Limited Liability Partnerships Act 2010.

A Limited Liability Partnership LLP is a combination of a partnership and a limited liability company. Here are the eligibility criteria of LLP venture in Malaysia. And b ordinarily resides in Malaysia.

A company limited by shares the most common type of limited companies. At least one of the partners has to be qualified to take position as a company secretary under the compliance of Companies Act 1965 Partners in this type of company has to be at least 18 years or over. Separate legal personality and capacity.

3 Any change in the partners of a limited liability partnership shall not affect the existence rights or liabilities of the limited liability partnership.

10 Limited Liability Partnership Agreement Templates In Doc Pdf Free Premium Templates

10 Limited Liability Partnership Agreement Templates In Doc Pdf Free Premium Templates

10 Limited Liability Partnership Agreement Templates In Doc Pdf Free Premium Templates

Pdf Limited Liability Partnership Llp Plt New Business Vehicle For The Malaysian Legal And Accounting Private Practice

Pdf Limited Liability Partnership Llp Plt New Business Vehicle For The Malaysian Legal And Accounting Private Practice

Setting Up A Business In Malaysia Ppt Download

Quickly Understand The Difference Between Sdn Bhd Llp Sole Proprietorship And Partnership Leh Leo Radio News

6 Types Of Business Entities In Malaysia Tetra Consultants

Limited Liability Partnership Act 2012

Pdf Limited Liability Partnership In Malaysia A Corporate Governance Perspective

Limited Liability Partnership Act 2012

Implementation Of The Limited Liability Partnership Malaysia Malaysian Taxation 101

St Partners Plt Chartered Accountants Malaysia Different Type Of Business Entities In Malaysia Part 2 Limited Liability Partnership In Malaysia The Type Of Business Available Are 1 Enterprise 2 Limited

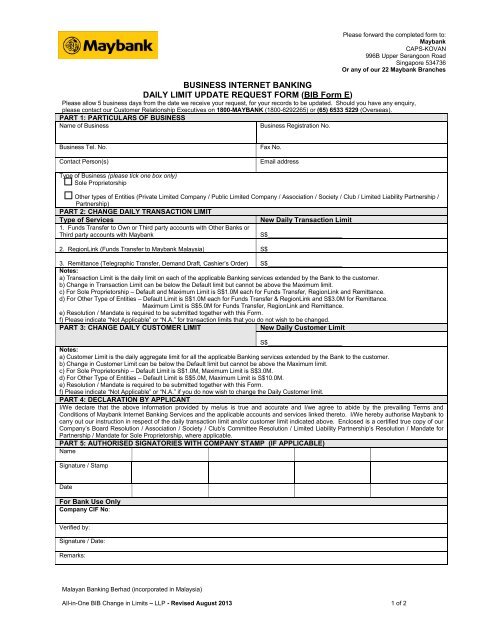

For Limited Liability Partnership Pdf Maybank

Understanding Limited Liability Partnership In Malaysia

Afif Rahman Chong Advocates Solicitors Corporate Commercial Conveyancing Intellectual Property Litigation Dispute Resolution Personal Data Protection Pdpa Due Diligence Trademark

How To Open A Bank Account For Your Malaysian Limited Liability Partnership By Aaron Tang Mr Stingy Medium

Llp Act 2012 Limited Liability Partnership 2021 Limited Liability Partnerships Act 2012 Act 743 Studocu